I have been asked to comment on Sloterdijk’s “gift-tax” proposal. A great opportunity, but note: I had not previously come across Sloterdijk or his fiscal thought experiment. I will keep my comments brief and leave aside the many practical, political, economic and legal problems associated with this idea.

In brief: The capacity of the State to impose mandatory taxes provides the basis for a mechanism through which political differences can be mediated. Democratic decision-making makes it possible for people to excercise power on a more equal footing. I’m not denying the impact of e.g. lobby-groups or ideologies; my point is simply that that impact would be even greater without the possibility for Parliament to allocate (some of) the funds. It makes a tangible difference whether e.g. the Liberals or the Socialists are in power.

Taxes are unpleasant for individuals, but the possibility of levying tax is a way to organize our society taking the principles of equality (“one man, one vote”) and legality as a departure point. Taxation can – under some circumstances – have a negative impact on social cohesion and trust. But this is mainly where taxation is perceived as unfair. In the current climate, the best way to increase trust is to tackle aggressive tax planning and tax avoidance.

Taxes are unpleasant for individuals, but the possibility of levying tax in a certain way is a way to organize our society taking the principles of equality (“one man, one vote”) and legality as a departure point. Taxation can – under some circumstances – have a negative impact on social cohesion and trust. But this is mainly where taxation is perceived as unfair. In the current climate, the best way to increase trust is to tackle aggressive tax planning and tax avoidance. Taxes shouldn’t be voluntary, they should be fair.

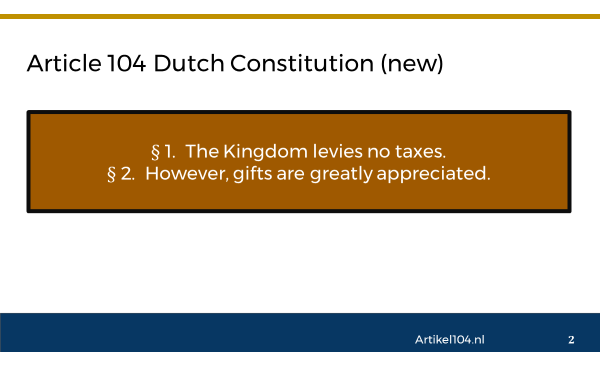

Constitutional basis

The starting point for taxation in the Netherlands is Article 104 of the Dutch Constitution, which states that: “Taxes of the Kingdom are levied on the basis of law”. This principle of legality should prevent tax for being an arbitrary, unchecked weapon for the State against its citizens and other potential taxpayers (not always the same thing). It enshrines the role of parliament, the rule of law and – indirectly – of human rights. Furthermore, Article 104 establishes a minimum for taxation: the State cannot levy more than what is legally determined, but – it is submitted – also not less. The tax burden shall always be based on law. This should rule out the controversial “sweetheart deals” for certain taxpayers, even aside from the impact of for example the State aid rules. A defining feature of “taxes” is that they are mandatory. The tax authorities have various powers to effectuate and enforce fiscal legislation. These powers are far-reaching, not in the last place in the context of information gathering and surveillance. And whilst taxation is legally speaking not a form of expropriation, it sure as hell can feel that way to the taxpayer.

The objective of “gift-taxes”

Leaving aside the mechanics of Sloterdijk’s proposal for gift-taxes, it is worth considering why this proposal has been made. As I understand it, the answer is not that Sloterdijk hates taxes per se, but that he views the tax system as problematic in the context of social cohesion and trust in society. More specifically, the current system of mandatory taxes is seen as detrimental because it amounts to forced solidarity with others. This creates resentment. This is, I think, what happens when some call something he dislikes a “waste of taxpayers’ money”. There are documented cases of taxpayers who refuse to pay tax on ethical grounds: e.g. they do not support military spending, abortion clinics or tax breaks for the rich.

Main question

Fiscal civil disobedience is not new. According to Sloterdijk, tax systems where people voluntarily contribute to the State would solve some of the problems mentioned above. The idea is that people, once freed from the tax man’s chains, will rustle up sufficient cash to keep the public sector afloat in a nicer way. Divorcing gift-taxes (as Sloterdijk apparently does) from both the practical, legal, economic and everyday political realities is – and I don’t want to be negative – a bit much. However, it does have one major advantage, namely it allows us to discuss the more interesting problem at heart of the proposal: Can gift-taxes contribute to more societal cohesion and a higher level of trust in society? I have some thoughts on this matter.

Gift-taxes

Sloterdijk seems te assume that giving generally results in a fit of the warm and fuzzies. A generosity driven dopamine rush, which will have us reaching for our wallets faster than Pavlov’s dogs at a village fete raffle. I’m not sure I agree with this version of giving. Every so often I donate EUR 50 or so to Oxfam Novib. I don’t feel especially good about it at all. It’s a drop in the ocean and I could clearly donate more if I wanted to. I don’t need the morning lattes to-go or the vinyl edition of Appetite for Destruction, so shouldn’t that money go to the starving urchins as well? At the same time, I feel guilty about not using the cash for sensible yet boring things which I do actually need (e.g. double glazing or painting the outside of the house) or simply saving it for a rainy day. Some of this is ethics, the rest just boils down to existential doubt.

Ignorance is bliss

I don’t know how much tax I pay. I doubt anyone does. The Netherlands has over thirty different taxes, levied over different things at different times, all funneling into the national account. Tax specialists generally dislike this complexity and every now and then someone will start up a project to “simplify” the system and make it “more transparent”. A bad idea! The fruit of the tree of fiscal knowledge should stay firmly on the branch. Even those why support mandatory taxation and the way in which it is used, would balk at the amounts needed to keep the public sector afloat. This is not to say that that sector is wasteful; the point is simply that it plays a major – an overwhelmingly positive – role in our society, which needs to be funded somehow. Some degree of “invisible” taxes (e.g. VAT or PAYE withholding taxes on wages) are a good thing, in the same way that sneaking extra vegetables into a toddler’s spaghetti is easier than a daily debate on the merits of vitamins and fiber.

Tax, politics & power

Taxation has various functions. Most obviously, it pays for stuff. This includes classical State functions (defense, infrastructure) and social State functions (schools, hospitals, welfare), and in this way helps redistribute wealth where needed. Taxes are also used to (dis)incentivize bad/good behavior and as a way of pricing externalities (carbon taxes offer an example of the latter). Other functions from the provision of subsidies and State aid to the servicing of the national debt. The tax system provides a sphere within which political differences (which do need solving) can be addressed and solved.

Libertarianism via the backdoor

Would this bargaining process work equally well with a pot of gift-money? I don’t think it would. Instead of going through the messy process of democratic decision making, taxpayers could/will simply contribute to the direct funding of a pet project. They are not locked into the system in the same way as with mandatory payments. It introduces an element of “vote with your feet”. Libertarians would argue that this is a good thing as it supposedly maximizes freedom. Although I like Ayn Rand as much as the next person, I don’t believe that the Dutch State (to give a concrete example) is so wildly incompetent and awful, that it should be replaced by millions of individual and essentially random spending decision by actors, who are fundamentally unequal and have diverging interests. 100 Monkies with a typewriter could, in theory, write Hamlet. But they probably won’t.

Sloterdijk’s gift-tax is not pitched is an alternative to the State. But in these hyper-individualistic times, donations in support of singing cats and wounded pigeons are more likely than gift-taxes for roads and schools. I don’t find this especially reassuring.

***

Photo by J. Mark Bertrand via Flickr.com under Creative Commons license.